The Facts About Tulsa Bankruptcy Legal Services Revealed

The Of Tulsa Bankruptcy Filing Assistance

Table of ContentsThe 20-Second Trick For Tulsa Ok Bankruptcy AttorneyHow Chapter 7 Vs Chapter 13 Bankruptcy can Save You Time, Stress, and Money.4 Simple Techniques For Tulsa Bankruptcy AttorneyWhat Does Chapter 7 Bankruptcy Attorney Tulsa Do?The Main Principles Of Best Bankruptcy Attorney Tulsa The Best Guide To Tulsa Bankruptcy Consultation

Individuals should make use of Phase 11 when their financial debts exceed Chapter 13 debt limitations. It seldom makes feeling in various other circumstances yet has much more choices for lien stripping and cramdowns on unprotected portions of guaranteed car loans. Chapter 12 bankruptcy is designed for farmers and fishermen. Phase 12 settlement plans can be much more flexible in Chapter 13.The means examination considers your typical regular monthly income for the 6 months preceding your declaring date and contrasts it versus the mean earnings for a similar house in your state. If your revenue is listed below the state typical, you immediately pass and do not have to finish the whole type.

If you are wed, you can file for insolvency jointly with your partner or independently.

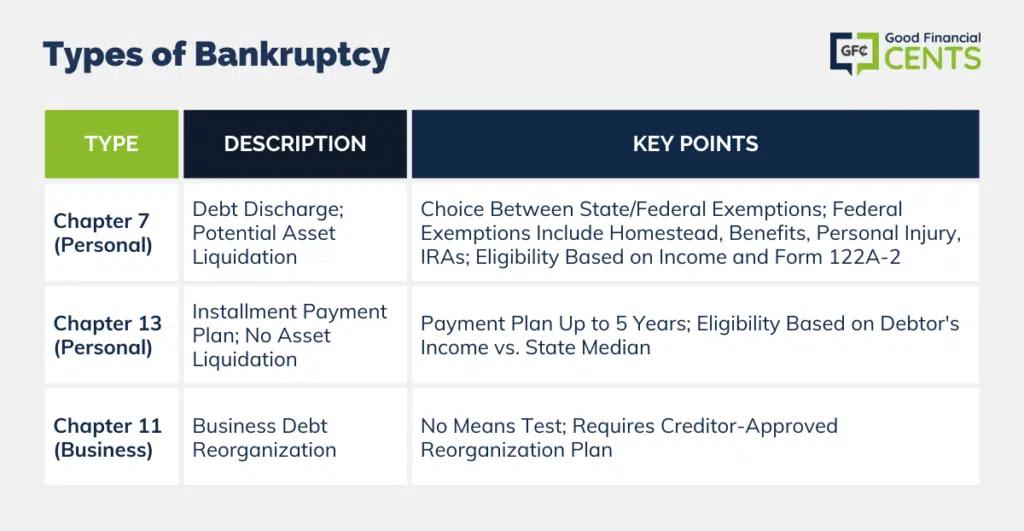

Declaring bankruptcy can aid a person by throwing out financial obligation or making a plan to repay financial obligations. A bankruptcy instance usually starts when the borrower submits a petition with the insolvency court. There are different kinds of bankruptcies, which are usually referred to by their chapter in the United state Bankruptcy Code.

If you are dealing with economic obstacles in your individual life or in your business, chances are the idea of declaring personal bankruptcy has crossed your mind. If it has, it also makes good sense that you have a great deal of personal bankruptcy inquiries that require solutions. Many individuals really can not respond to the question "what is insolvency" in anything except basic terms.

If you are dealing with economic obstacles in your individual life or in your business, chances are the idea of declaring personal bankruptcy has crossed your mind. If it has, it also makes good sense that you have a great deal of personal bankruptcy inquiries that require solutions. Many individuals really can not respond to the question "what is insolvency" in anything except basic terms.Lots of people do not recognize that there are a number of types of bankruptcy, such as Chapter 7, Chapter 11 and Chapter 13. Each has its benefits and obstacles, so knowing which is the most effective choice for your present circumstance along with your future recuperation can make all the distinction in your life.

All About Tulsa Bankruptcy Lawyer

Chapter 7 is termed the liquidation insolvency chapter. In a chapter 7 personal bankruptcy you can get rid of, wipe out or discharge most types of debt.

Several Phase 7 filers do not have much in the means of properties. Others have residences that do not have much equity or are in major requirement of fixing.

The quantity paid and the period of the plan relies on the borrower's property, typical revenue and expenses. Lenders are not permitted to pursue or keep any kind of collection activities or suits during the case. If effective, these financial institutions will be erased or released. A Phase 13 bankruptcy is extremely effective due to the fact that it provides a mechanism for borrowers to avoid foreclosures and sheriff sales and quit repossessions and utility shutoffs while catching up on their secured debt.

Everything about Top-rated Bankruptcy Attorney Tulsa Ok

A Chapter 13 instance might be helpful because the debtor is permitted to obtain captured up on home mortgages or vehicle finances without the hazard of repossession or repossession and is allowed to keep both excluded and nonexempt building. The debtor's strategy is a record detailing to the personal bankruptcy court exactly how the borrower proposes to pay present costs while site web paying off all the old financial debt balances.

It offers the borrower the possibility to either offer the home or end up being captured up on home loan settlements that have dropped behind. A person filing a Phase 13 can recommend a 60-month strategy to treat or become current on home mortgage payments. For example, if you fell back on $60,000 well worth of home mortgage payments, you might suggest a strategy of $1,000 a month for 60 months to bring those home mortgage repayments current.

It offers the borrower the possibility to either offer the home or end up being captured up on home loan settlements that have dropped behind. A person filing a Phase 13 can recommend a 60-month strategy to treat or become current on home mortgage payments. For example, if you fell back on $60,000 well worth of home mortgage payments, you might suggest a strategy of $1,000 a month for 60 months to bring those home mortgage repayments current.The Main Principles Of Tulsa Ok Bankruptcy Attorney

In some cases it is better to stay clear of insolvency and work out with financial institutions out of court. New Jersey additionally has an alternate to bankruptcy for businesses called an Job for the Benefit of Creditors and our law practice will look at this option if it fits as a potential strategy for your business.

We have actually produced a device that aids you select what phase your data is more than likely to be filed under. Click below to utilize ScuraSmart and learn a feasible option for your financial obligation. Lots of people do not recognize that there are numerous sorts of bankruptcy, such as Phase 7, Chapter 11 and Phase 13.

Right here at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we manage all kinds of bankruptcy instances, so we are able to answer your personal bankruptcy questions and help you make the most effective decision for your situation. Here is a short take a look at the financial obligation relief options offered:.

Tulsa Bankruptcy Filing Assistance Things To Know Before You Get This

You can just file for bankruptcy Before declare Chapter 7, at the very least among these should be true: You have a lot of financial obligation revenue and/or possessions a financial institution might take. You lost your motorist permit after remaining in a mishap while uninsured. You require your license back (bankruptcy lawyer Tulsa). You have a great bankruptcy lawyer Tulsa deal of financial debt near the homestead exception quantity of in your home.

The homestead exemption amount is the better of (a) $125,000; or (b) the area typical price of a single-family home in the coming before schedule year. is the quantity of cash you would maintain after you sold your home and repaid the mortgage and other liens. You can locate the.